Help your clients avoid the fear of missing out

Would you rather listen than read? Check out the audiocast of this article

For financial professionals, managing client portfolios is a relatively straightforward part of the job—at least in comparison to managing client expectations in today’s environment. With heightened market volatility and ongoing uncertainty, investors are often highly emotional. As a result, says Sid Miramontes, president of Miramontes Capital in Newport Beach, California, “It seems like the financial professional business currently is more psychological than it is fundamental investment and technical analysis.”1

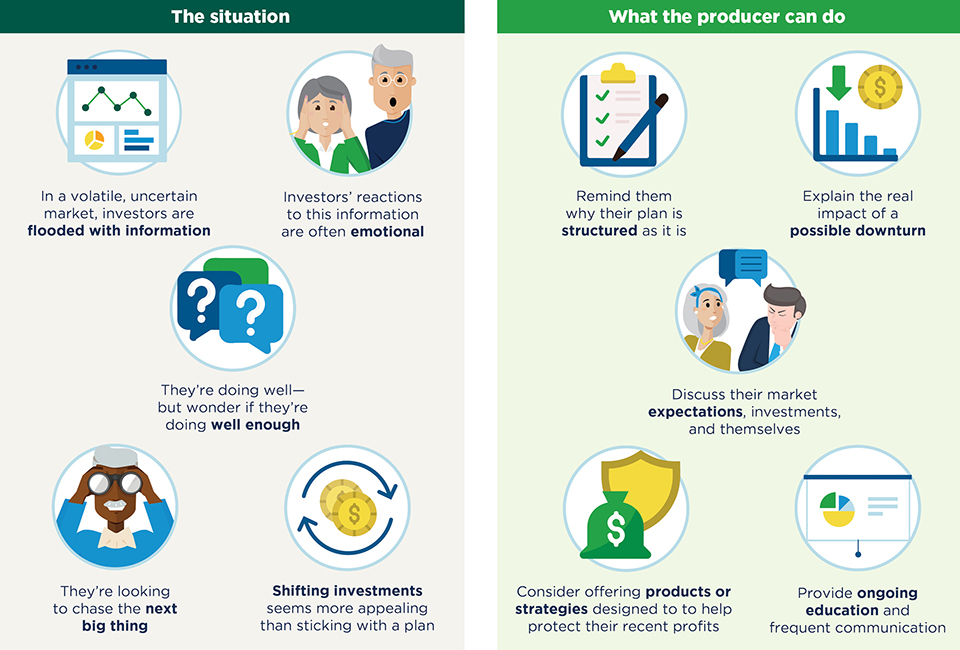

One factor, in particular, is having a significant impact on client expectations: the recent bull market. In addition to the market performance itself, investors are flooded with information—some good, some not so good—about investment opportunities and strategies and the next big growth opportunity they should get in on. Thus, even for clients whose portfolios are doing very well, there can be a sense that it’s not quite enough. “That’s the world we live in today,” says Miramontes. “Everyone has a fear of missing out.”

Whether clients are worried about the future or fear missing out, the result can be an emotionally driven view that makes sudden investment shifts more appealing. “This all weakens the investor’s staying power to stick with a plan and makes them think about chasing the next big thing,” says Miramontes. For producers, managing those expectations is key to serving clients effectively and helping them stay focused to meet their goals.

“When the client gets upset about something, our job isn’t to explain it away with charts and graphs.”

Start with the fundamentals

To manage unrealistic client expectations, financial professionals can begin with education—reviewing why the client’s plan is structured the way it is and how it balances growth and protection designed to meet their goals. At times, it may be worth revisiting the fundamentals with the client to address questions of “basic financial literacy,” says Wade D. Pfau, professor of Retirement Income at The American College of Financial Services. “When you read media articles about investing, it’s usually a story along the lines of, ‘if you save $25 a month, you’ll be a millionaire.’” However, he explains, those projections assume growth rates of 8%, 10%, or even 12% a year, which is unlikely because of the outsized impact of downturns. Some investors, he says, “may not understand that if the market drops 50%, it has to gain 100% to get you back where you started.”

Pfau also notes that “recency bias” can color investors’ expectations. “Research shows that when people are deciding what to do with a traditional pension—take a lump sum or the lifetime income—their decisions are related to recent stock market performance. If the market has done well recently, they typically want to take out the lump sum. If it’s done poorly, they usually prefer the lifetime income option,” he says. “With the stock market doing so well for so long, people tend to extrapolate that into the future.” And the result can be an investor who has amplified expectations for growth and who sees little likelihood of a downturn.

Help Your Clients Avoid the Fear of Missing Out

Envision the reality of downturns

With the long bull market, investors haven’t seen an extended downside for some time, and younger investors have never experienced one at all. Thus, they may have an intellectual understanding of market declines, but no visceral sense of the experience. “Many people don’t understand what the downside feels like,” says Miramontes. “So we have to bring them back to reality a little bit. Part of that is reframing things so that they really think about what a downside would feel like if it were their capital. A lot of the time, financial professionals will talk about this kind of thing in percentages. But if you really want this to hit home for the client, you often have to express it in dollars—ask them, ‘If you put $1 million here, obviously you want to see it grow to $2 million. But are we OK if it were to drop to $600,000?”

Using the right language can be important in reaching clients. With those who are focused too heavily on growth, for example, it may be useful to begin by pointing out the success they’ve already enjoyed. “You can say, ‘You’ve generated some pretty significant profits over the past 12 or 13 years, and we don’t want to lose those. So let’s talk about a product that is designed to protect your profits,’” says Jeannie Underwood-Kotner, senior vice president and head of Global Atlantic Consulting, Global Atlantic Financial Group. “I would suggest that words like this be used as they may resonate with certain people.”

To help investors stay centered on sound investment strategies, financial professionals can draw on a range of tools. When dealing with unrealistic expectations, however, they should consider doing more than providing a wealth of statistics. “We typically use tools such as Morningstar, Bloomberg and Schwab research, Reuters, and the financial press, among others,” says Miramontes. “But in truth, what we use more than anything else is just straight talk. Clients are already inundated with information. We really try to boil it down to simple, clear points that can help them understand the situation and make decisions. When the client gets upset about something, our job isn’t to explain it away with charts and graphs.”

Keep the channels open

To a great extent, managing unrealistic expectations means staying in touch with clients to provide ongoing education and to understand what they’re thinking. To that end, Global Atlantic’s Underwood-Kotner recommends that producers ramp up client interactions and develop a clear communication plan. As a guideline, she points to research on “experienced-based” financial professionals. These producers tend to look at the larger context of clients’ lives that drive investing decisions—an approach that can be useful when trying to understand and manage expectations.

Experience-based producers place a heavy emphasis on communication. On an annual basis, she notes, they average 11.6 in-person meetings and 20.6 emails with each client, provide 6.4 educational events, send out 12.7 mailings, and attend 7.0 social events with clients.2 “It generally starts with more communication,” she says. “And many people will really appreciate it when a little more attention is paid to them.”

Renewed communications efforts may seem unnecessary with a booming market, but financial professionals should check their own expectations on that front. “Many producers are making more money than ever before,” Underwood-Kotner says. However, that growth has been driven largely by market appreciation, not client acquisition. Recent research, she says, found that about two-thirds of surveyed financial professionals have actually seen negative growth over the past five years, once market growth is factored out of the equation. “So they aren’t really growing their practices and shouldn’t get complacent,” she says.

Communications efforts should be two-way and seen as an opportunity to listen. Underwood-Kotner recommends that producers sit down with clients and interview them about their expectations for markets, their investments, and themselves. “You can just put that on the table, and if their expectations are out of whack with reality, you can help them understand where those expectations are coming from and manage them down a little,” she says.

“You need to equate questions to concerns,” says Miramontes. “When a client has a question about something, it means they have a concern about it. So you may have to dig a little deeper and see what they’re afraid of.” They may be worried that missing out on a hot investment will mean running out of money in the long term, or that a sudden downturn in the market will mean they have to sell their house or won’t be able to help a grandchild with college.

“When you find out what their underlying concern is, you typically solve for that,” he says. At that point, it becomes possible to show clients the specifics of how their plans are set up to ride out market swings and provide income—even if they don’t get in on that next big thing.

“When you’ve been in this business longer, you realize that clients usually just want to know that they are on the right track,” says Miramontes. “They want to know that whether the market gets hit with a major correction or sees continued growth, their plan is still good and in place.”

Share

Related resources

More on Practice Management

Your Thriving

Practice

A destination to empower financial professionals to build, manage, and grow their practice

Get started with Global Atlantic

Take the next step with a company that can help elevate your business.

Need help?

Find all the contact information to submit and service your business.