The views and opinions expressed in any third party articles are those of the respective authors and do not represent those of Global Atlantic or its subsidiaries.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Taxable distributions (including certain deemed distributions) are subject to ordinary income taxes, and if made prior to age 59½, may also be subject to a 10% federal income tax penalty. Distributions received from a non-qualified contract before the Annuity Commencement Date are taxable to the extent of the income on the contract. Payments from IRAs are taxable in accordance with the normal rules surrounding taxation of payments from an IRA. Early surrender charges may also apply. Withdrawals will reduce the death benefit and any optional guaranteed amounts in an amount more than the actual withdrawal.

This information is written in connection with the promotion or marketing of the matter(s) addressed in this material. The information cannot be used or relied upon for the purpose of avoiding IRS penalties. These materials are not intended to provide tax, accounting or legal advice. As with all matters of a tax or legal nature, you should consult your tax or legal counsel for advice.

Diversification and rebalancing do not protect against market fluctuations and do not assure a profit or protect against a loss.

Guarantees are based on the claims-paying ability of Forethought Life Insurance Company and assume compliance with the product’s benefit rules, as applicable.

There are a multitude of different products that may be accessed for retirement income needs. For example, stocks, bonds, mutual funds, managed payout funds, and variable annuities are securities and have different risk/reward characteristics, liquidity properties and tax consequences, particularly when compared to products such as CDs, savings accounts, money market accounts, fixed annuities and fixed index annuities. Certificate of Deposits (CDs) are bank products that are FDIC insured. Money Market funds are securities and are not FDIC insured and although these funds seek to preserve the value of an investment at $1.00 per share, there is no guarantee they will maintain this value.

A fixed index annuity (FIA) is intended for retirement or other long-term needs. It is intended for a person who has sufficient cash or other liquid assets for living expenses and other unexpected emergencies, such as medical expenses. A fixed index annuity is not a registered security or stock market investment and does not directly participate in any stock, bond or equity investments or index. Fixed annuities are not FDIC insured.

FIA interest crediting methods vary and may involve different methodologies such as fixed rates, index caps, spreads and participation rates and are declared in advance and guaranteed for the entire strategy term. An annual cap is the highest rate of interest that will be credited to a fixed index annuity annual cap strategy. Index based crediting methods credit 0% if the index performance is less than or equal to the spread. The participation rate is the established percentage of the interest that is credited to a fixed index annuity for a strategy term. If Index performance is negative for any strategy term, the fixed index annuity interest credit will be 0.00%.

An annuity purchased for a tax-qualified retirement account does not provide any additional tax deferred treatment of earnings beyond the treatment that is already provided by the tax-qualified plan itself.

Repositioning of assets from any product into an annuity contract may not be suitable for all clients. Clients should carefully consider factors such as remaining surrender charge schedule, possible market value adjustments and any other charges before determining if repositioning and/or exchanging of an existing annuity contract is right for their particular situation. State insurance replacement regulations may also apply.

Global Atlantic Financial Group (Global Atlantic) is the marketing name for Global Atlantic Financial Group Limited and its subsidiaries, including Forethought Life Insurance Company and Accordia Life and Annuity Company. Each subsidiary is responsible for its own financial and contractual obligations. These subsidiaries are not authorized to do business in New York.

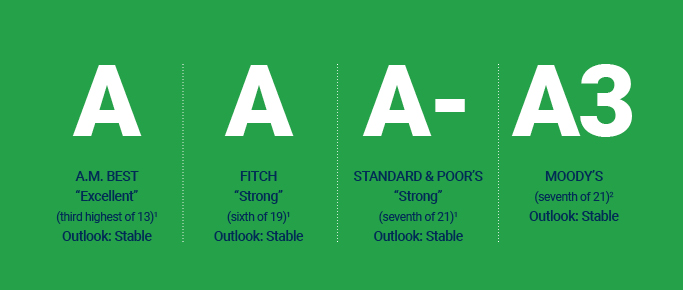

Insurance Company Ratings

1Applies to the individual financial strength of Accordia Life and Annuity Company, Commonwealth Annuity and Life Insurance Company, First Allmerica Financial Life Insurance Company, Forethought Life Insurance Company and Global Atlantic Re Limited.

2Applies to the individual financial strength of Accordia Life and Annuity Company, Commonwealth Annuity and Life Insurance Company, First Allmerica Financial Life Insurance Company and Forethought Life Insurance Company.

Ratings apply to the issuing companies and do not apply to any specific product or underlying fund. Each individual insurer is solely responsible for the benefits and obligations of the products it issues.

Ratings as of July 9, 2020.